Part 2: The Fat-Finger

OR

The story of how a misplaced decimal point at Alameda Research caused a market crash that echoed around the world.

This incident happened just a few weeks after I joined Alameda. I had just gotten a hang of our engineering workflows and was starting to wrap my head around our trading systems.At a high level, Alameda's trading operated in two modes:

The main one was our semi-systematic strategies, where traders set model parameters that control a complex automated trading system. This way, traders aren't placing actual trades, but rather fine-tuning an algorithm that decides how to execute those trades at high frequency.

However every once in a while, a trader would need to manually execute a trade. Usually this might happen if our automated trading systems were being buggy due to market volatility, or if there was an arbitrage opportunity on a venue where we hadn't set up automated trading yet.

Our automated trading systems handled the vast majority of Alameda's trading. So naturally, we had sanity checks in place to make sure that the orders being sent were reasonable relative to current market prices. Not so for manual trades, which were by nature discretionary.

The tricky thing about risk is that it's usually invisible, right up until it comes around and bites you in the ass.

Well, on October 21 2021, an Alameda trader's finger slipped.

The trader was trying to sell a block of BTC in response to news, and sent out the order via our manual trading system. What they missed was the decimal point was off by a few spaces. Rather than selling BTC at the current market price, they sold it for pennies on the dollar.

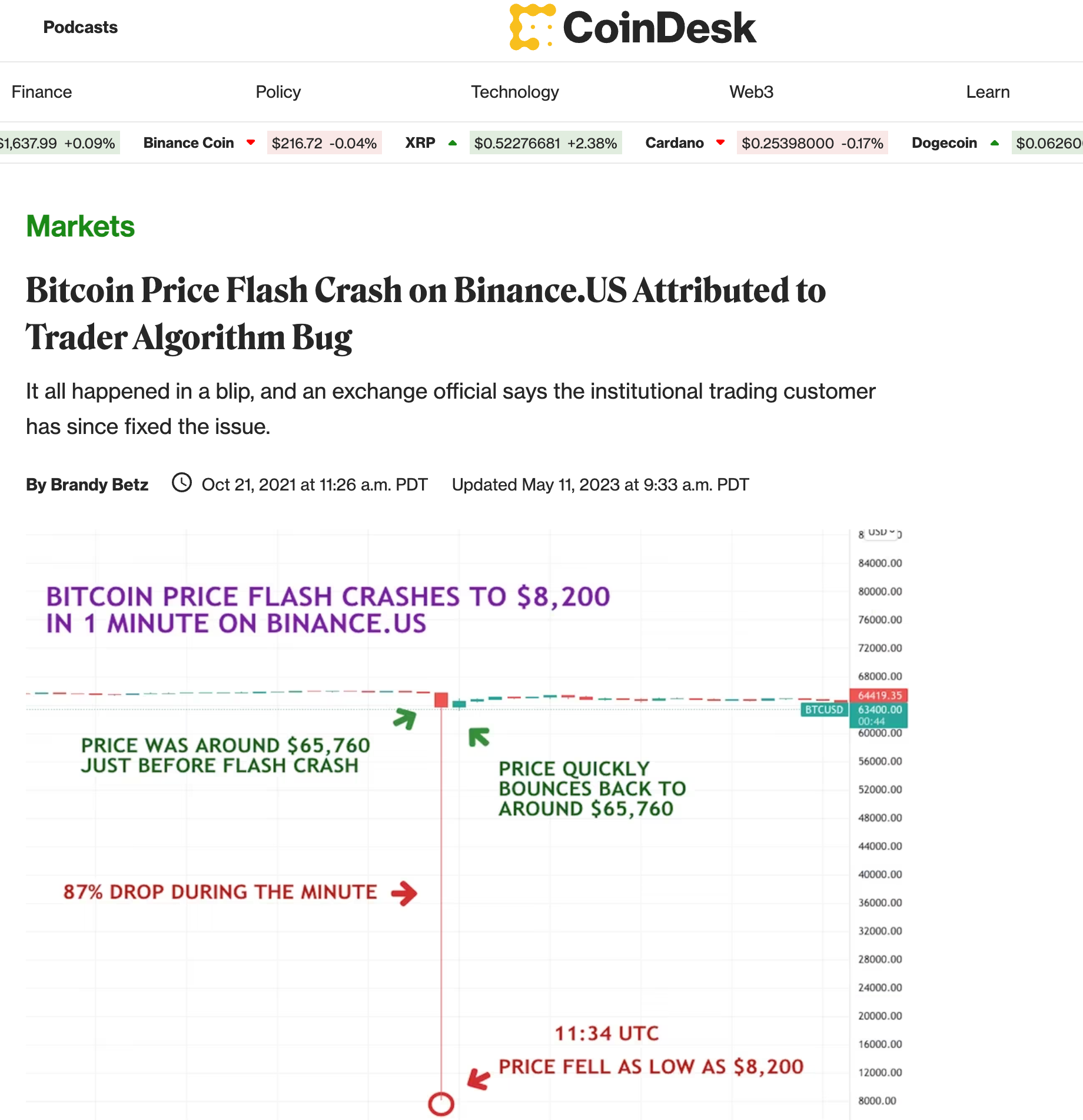

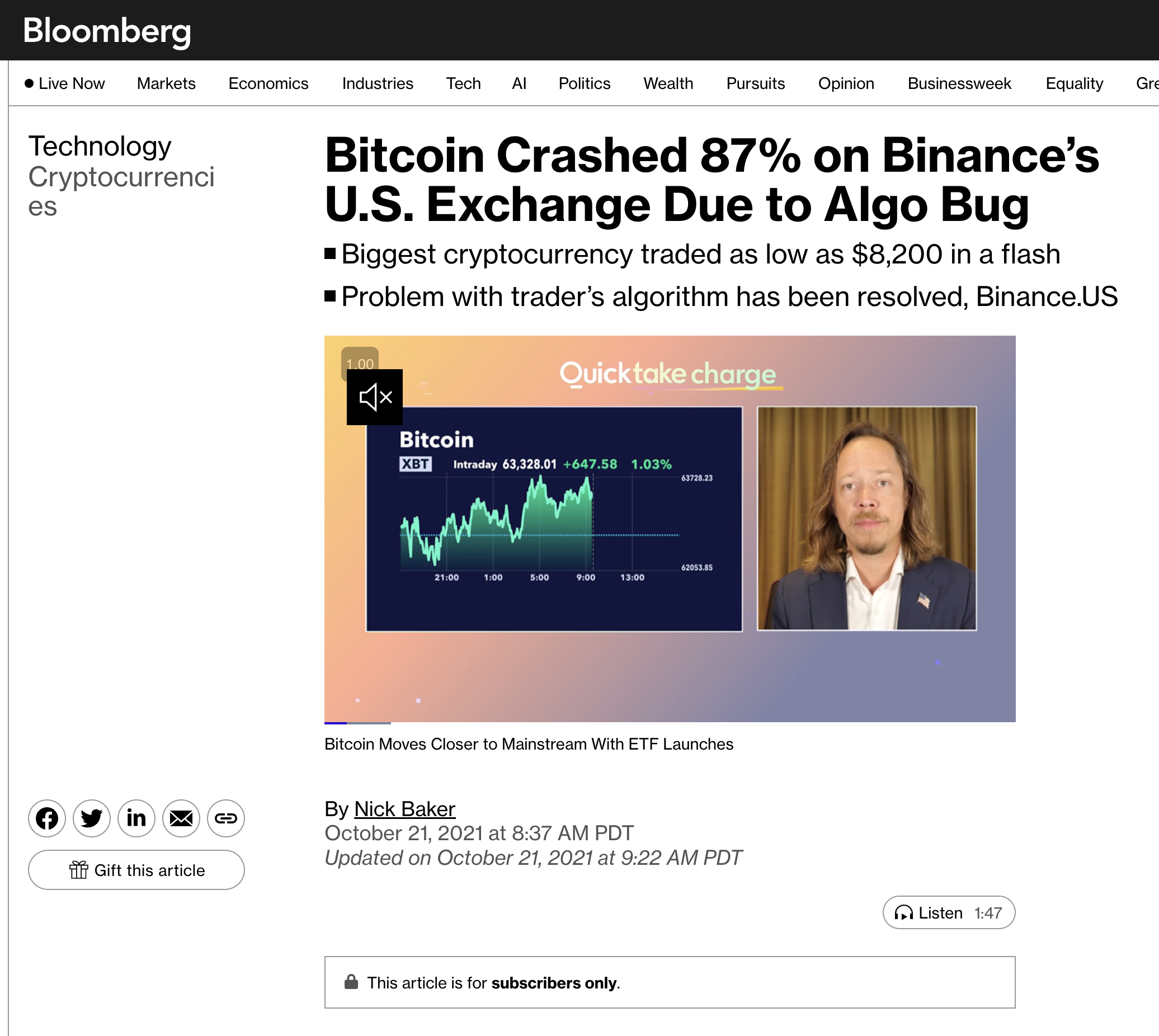

The result was immediate. The price of BTC shot from a high of $65k to as low as $8k on some venues, only to be quickly restored by arbitrageurs.

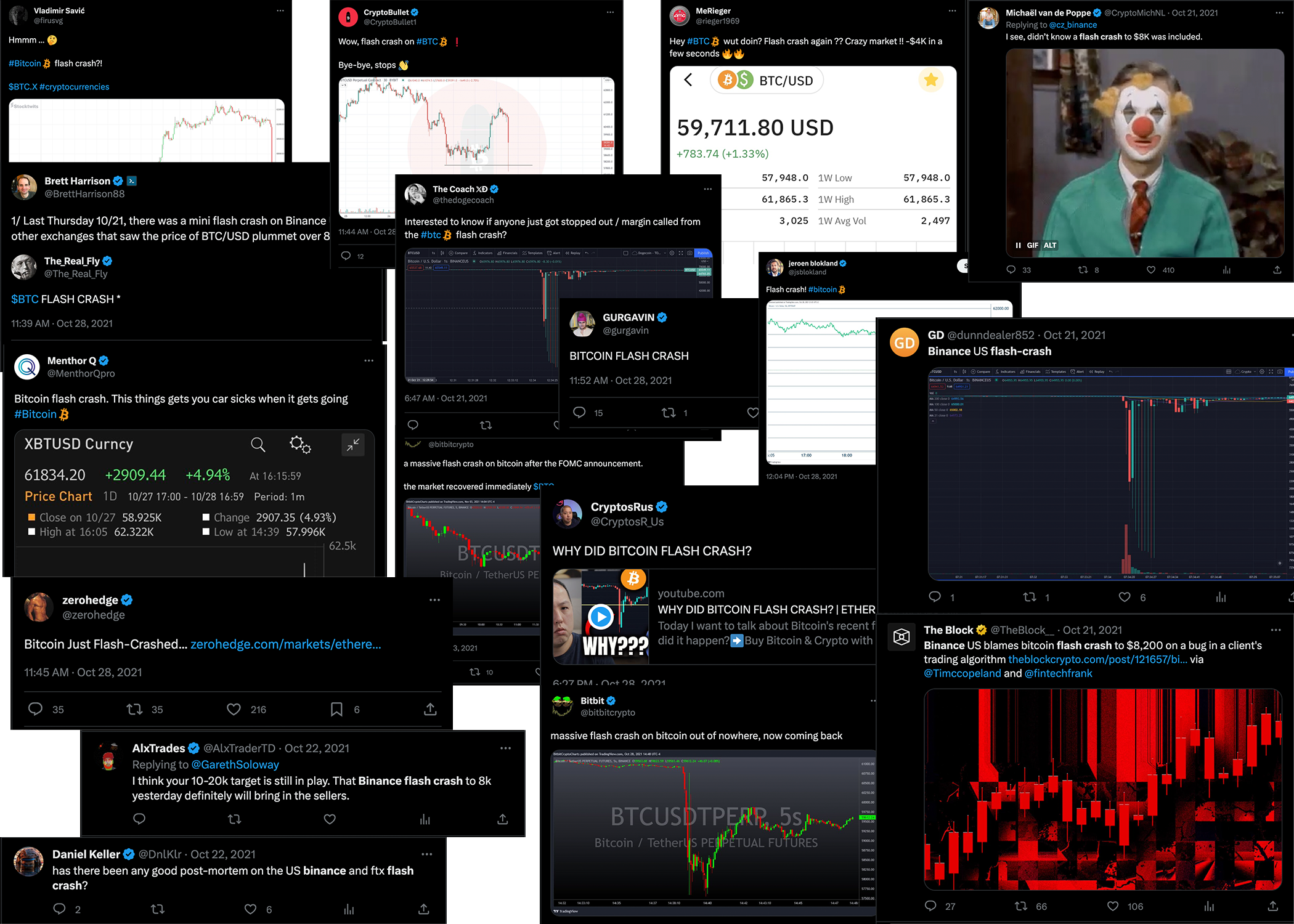

The sudden price movement lit crypto Twitter on fire as traders scrambled to figure out what was going on:

News outlets started picking up too. Binance US - which was the epicenter of the flash crash - released a statement claiming that it had been caused by one of their "institutional traders" who had a "bug in their trading algorithm".

I guess Caroline had made some phone calls.

Alameda's losses on the fat-finger trade were staggering - on the order of tens of millions. But because it had been an honest mistake, there wasn't much to do except to implement additional sanity checks for manual trades. And that's what we did.

That's usually how things worked at Alameda - we would wait until something broke, and then rush to fix it. Which is why it took us so long to implement sanity checks that any "traditional" trading firm would have never started trading without.

After that, it was back to business as usual. According to SBF, the utility we gained by moving fast outweighed the occasional costs we paid due to poor risk checks, hacks, and the like. This was SBF's work philosophy, and it drove the culture he created at Alameda and FTX

For almost two years, the BTC flash crash incident has remained a mystery in the minds of the public. Now you know who was responsible, and what was happening behind the scenes.

Liked this post? If so, drop a reply on the Twitter thread with what you want to hear about next!